Just when community bank marketers were starting to get comfortable with AI and digital marketing, the landscape is shifting once again. For years, marketers have labored to master search algorithms, strategize SEO and achieve that enviable top position on the search engine results page (SERP). Some took the more arduous route, with rich content and thoughtful (and often expensive) SEO, while others chased fast fixes like keyword stuffing.

Now, enter the “zero-click” era. As Bain explains in “Goodbye Clicks, Hello AI,” AI-powered search engines and generative AI summaries are becoming the norm. Instead of clicking through to a website, users see answers right on the SERP. That’s what zero-click means: no click required.

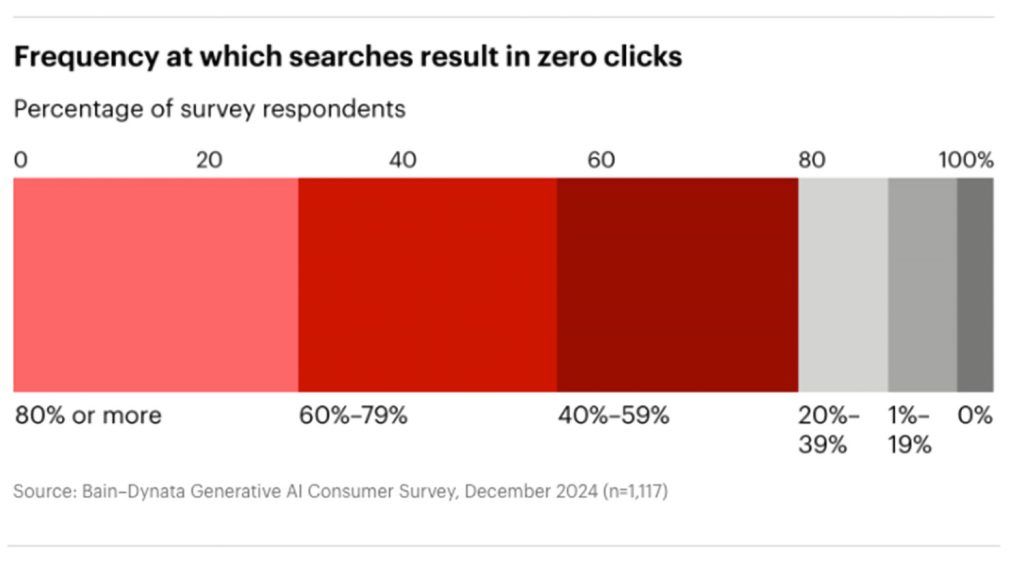

The transformation to zero-click is gaining traction. A Bain survey indicates that approximately 80% of consumers rely on zero-click results for at least 40% of their searches, which is estimated to result in a 15-25% reduction in organic web traffic. For community banks that lean heavily on organic discovery, that change hits hard.

Why It’s a Big Deal for Banks

In the not-too-distant past, the search game followed a straightforward buyer journey or funnel: content → clickthrough → engagement → conversion. When someone typed in, say, “how do I open a business checking account?”, that was a bank brand’s moment to shine; someone was following the traditional funnel from content to conversion. However, with AI summaries taking over, that moment of engagement is fading away.

Here are the main challenges:

Losing Share in Discovery Searches

Bain points out that as clickthrough rates drop, marketers are losing “share of voice” in non-branded searches — early-stage queries from people who don’t yet know which bank they’re considering. AI systems compile answers from multiple sources and prioritize those deemed most authoritative or cited.

A bank marketer’s carefully crafted content might help inform that summary, but that doesn’t necessarily mean that the bank will get a mention. For instance, someone might ask about “the best mortgage rates in Charlotte, NC.” The AI summary might mention big national banks, brokers or credit unions, while the bank that spent considerable time and money on “carefully crafted content” doesn’t even appear in the SERP.

Format and Structure Matter More Than Ever

The SEO tactics that many marketers have been relying upon for years — keyword stuffing, lengthy blog articles, infographics, gated e-books and white papers — are no longer the “go-to” optimization opportunities they once were. AI crawlers and summarization engines favor content that’s well structured, semantically rich (where keywords and variations are used naturally), and broken into digestible sections (e.g., FAQs, definitions, lists). Many of the traditional marketing communication assets don’t fit that bill.

As The Financial Brand puts it in their Sept. 23 article, “AI Referrals Are Surging; Are You Ready for the New Customer Journey?”: “AI search engines analyze query intent, cross-check multiple sources, and prefer consistent, authoritative content. This requires structured, machine-readable content across multiple channels.”

Click Metrics Become Less Reliable

In a world where fewer people click through, traditional key performance indicators (KPIs), such as clickthrough rate (CTR), organic traffic and time on page, lose their significance. You might publish great content, but if no one’s clicking, how do you know what’s working?

Fewer Resources

Large banks or fintechs can test new formats, invest in AI tooling and rapidly iterate. Community banks usually have lean marketing teams and smaller budgets. That makes any transformation more challenging.

What Community Banks Can Do: Adapt and Experiment

While the environment is shifting, there are strategies that can help community banks maintain visibility and relevance.

- Pick a niche. Don’t try to compete on every financial keyword. Focus on local or specialized topics (e.g., “small business lending in [your county]” or “community development programs in [region]”). Own that space and increase your chances that AI systems will pick you.

- Make your content more AI-friendly. Structure your pages thoughtfully: Use clear headings, FAQs, bulleted lists, definitions and short-answer blocks. Use schema markup* to structure and clarify the purpose of your content.

- Diversify formats. Utilize informational videos and interactive tools, including calculators, quizzes and chatbots. AI summarizers not only pull from multimedia formats; they favor them.

- Invest in conversational agents. Customers accustomed to the dynamic Q&A interface of ChatGPT have come to expect a similar experience from websites. According to The Financial Brand article: “Moving beyond rules-based chatbots toward AI-powered agents makes it possible to answer nuanced questions, maintain brand voice and hand off seamlessly to human staff when needed.”

- Boost domain authority. Leverage press mentions, local news coverage and partner content. Use citations and backlinks to establish credibility and trust. AI algorithms seek out brands that it determines are known and trusted.

- Collaborate locally. Work with community organizations, local governments or chambers to co-create content. This may help amplify reach and give additional signaling to AI systems via shared authority.

What’s Next?

Community banks now find themselves operating in a search environment transformed by AI and must rethink content optimization beyond keywords and clicks. Although resource constraints and competition from larger players exacerbate the challenge, community banks that adapt will be able to maintain their relevance in this new, zero-click world.

*Schema markup sends explicit signals to search engines and AI regarding the scale and scope of a piece of content. For example, if a search engine reads the word “apple” on a page, schema can clarify whether the content is about the fruit or the company. For additional information on the topic, Neil Patel’s blog is a helpful resource.

About Bank Marketing Center

Bank Marketing Center is the leading provider of subscription-based automated marketing services to community banks. Our goal is to help bank marketers with topical, compelling communication that builds trust, fosters relationships and drives revenue. We achieve this by automating critical bank marketing functions, including content creation, social media management, digital asset management and, of course, content routing. These services enable a community bank to create and distribute content that drives business without fear of fines, brand damage or customer attrition.

Want to learn more about what we can do for your community bank and your marketing efforts? Visit bankmarketingcenter.com, or you can contact me by phone at (678) 528-6688 or email at nreynolds@bankmarketingcenter.com. As always, I welcome your thoughts.