By Scott Hildenbrand, Managing Director, Head of Balance Sheet Analysis and Strategy, Head of Piper Sandler Hedging Services

This year has presented bank management teams with a multitude of issues to juggle, many of which seemingly pull in opposing directions and most of which were not firmly on the radar to start the year. Such is life in 2020. Some banks’ primary concerns stem from the fact that the industry has seen a shift in liquidity. Balance sheets are awash with deposits relative to recent periods, while securities holdings have come down relative to assets. The build-in balance sheet liquidity has come in the form of cash, with an unusually high 7.6% of assets held in cash and equivalents as of June 30.

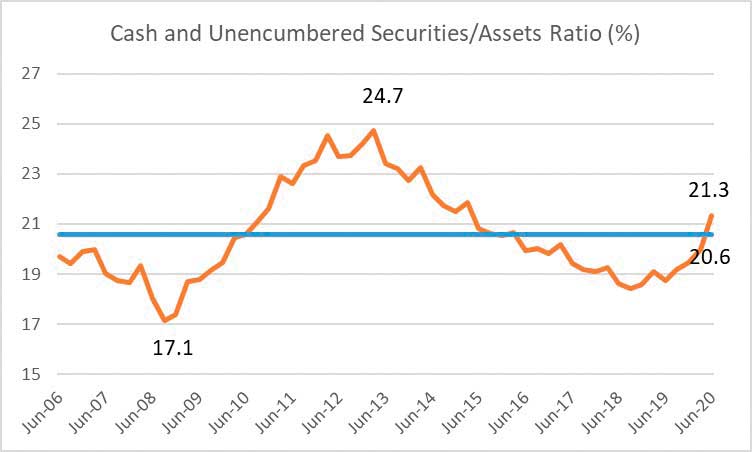

This drastic change in the liquidity picture is best encapsulated by the Cash and Unencumbered Securities-to-Assets Ratio’s significant uptick. The ratio has surpassed the average over the past 14 years of 20.6%, steadily climbing toward the high of 24.7% last seen in 1Q13.

While every institution is unique, many banks have responded to the shift in liquidity by asking two questions: how does this affect the asset side, and what are the options on the liability side? On the asset side, management teams wonder what to do with excess cash in a world where most bond yields are disappointingly low. Even though liquidity profiles appear strong and are trending stronger, economic uncertainty creates unpredictability in depositor behavior.

As such, some institutions feel more comfortable with investments that maintain maximum flexibility in the future — saleability and pledgeability — with lower yield as a trade-off. Other institutions have looked to extend their investment portfolios further out on the curve to increase yield while mitigating tail risk by match funding with 5+ year structures at historically low rates. For instance, banks have worked with some firms to utilize their inexpensive, longer-dated funding mechanisms at attractive rates.

Many corners of the banking industry are concerned that low rates, slower loan origination, and excess liquidity trends are here to stay for the foreseeable future, and have begun searching for loan surrogates. Allowing these banks to extend their liability portfolio’s duration at a scalable level opens the door to more asset purchase strategies. We have seen two specific asset strategies gain momentum: exploring community and regional bank subordinated debt as an investment option and analyzing how to invest in municipals without ruining their interest rate plan. As an alternative to extending the liability portfolio, some institutions have swapped fixed rate municipals to floating, thus obtaining an attractive yield with reduced duration risk and protecting Tangible Common Equity. Exploring risk/reward profiles of earning assets is nothing new to balance sheet managers, but the environment has certainly evolved since the start of 2020.

Managing excess liquidity while planning for interest rate risk management has also become slightly more complicated on the liability side. How does a bank choose from the various funding options and hedging strategies available? The decision-making process must consider balance sheet composition (i.e., the availability of liabilities to hedge), impact to earnings and capital (in addition to liquidity) from the strategy, and practical applications, such as hedge accounting.

It’s generally recommended for accounting simplicity and hedging flexibility to first evaluate liability hedges when attempting a shift in interest rate risk profile. Many institutions took advantage of both spot-starting and forward-starting cash flow hedges over the past year. Forward-starting swaps on forecast borrowings allow the bank to purchase longer duration assets today and know they will maintain the future’s attractive spread. For example, offerings like IntraFi Network’s (formerly Promontory Interfinancial Network) IntraFi Network Deposits give banks the ability to launch these funding contracts six months to one year in the future, while locking in their rate now to hedge against any increase in funding costs before the launch date. This allows the bank maximum flexibility in planning its liquidity now and well into the future.

But what about banks flush with liquidity with no future funding needs anticipated? Part of the answer arose from a surprising place: dealing with yet another source of stress — the LIBOR transition. The FASB released ASC 848 Reference Rate Reform in March 2020 to address potential concerns about the impact of the upcoming LIBOR transition on hedge accounting. Although LIBOR fallback is expected at year-end 2021, guidance is applicable immediately to help users explore potential alternative contracts and rates. It allows banks to be proactive in dealing with LIBOR cessation and identify a new hedged exposure. The bank can then modify the hedge to match the new (non-LIBOR) exposure, adjusting the fixed-rate or adding a floating rate spread to keep the transaction NPV-neutral. Finally, the bank can amend their hedging memo to reflect the new exposure, and the hedge relationship continues without de-designation.

There is a positive balance sheet strategy development that comes from this guidance. By allowing banks to consider a change to a non-LIBOR hedged item, it essentially provides added flexibility to banks that have implemented strategies using wholesale funding paired with swaps, a strategy that many banks smartly continue to explore. The guidance allows those banks to consider replacing the existing funding with other sources for cheaper and more customizable wholesale borrowings or even deposit products, without impacting hedge accounting. These products allow a bank to replicate the previous funding instruments’ details, but at a considerably discounted cost. Banks can leverage the new accounting guidance to change the hedged exposure from wholesale funding to deposits without a re-designation event, allowing the bank to pay down wholesale borrowings. For those banks that now have many more deposits than when they first implemented the strategy, reducing their current need for wholesale funding, this is a welcome change in funding source that maintains the interest rate protection they continue to need.

This rule can be applied in a variety of different ways. Banks can make changes to the interest rate index, the spread to that index, the reset period, pay frequency, business day conventions, payment and reset dates, the strike price of an existing option, the repricing calculation, and may even add an interest rate cap or floor that is out-of-the-money on a spot basis. On the other hand, some aspects of the hedge are unrelated to the reference rate reform: an institution cannot effect a change to the notional amount or maturity date, change from an interest rate to a stated fixed rate, or add a variable unrelated to LIBOR.

Ultimately, none of these options singlehandedly solve the problem of too much liquidity with too few safe places to deploy them while earning an attractive yield and protecting against the eventuality of rising rates. Like life in 2020, the key is to deploy various creative tactics to weather the storm and emerge a stronger institution.

Scott Hildenbrand, Managing Director, Head of Balance Sheet Analysis and Strategy, Head of Piper Sandler Hedging Services

This story appears in Issue 4 2020 of the Utah Banker Magazine.